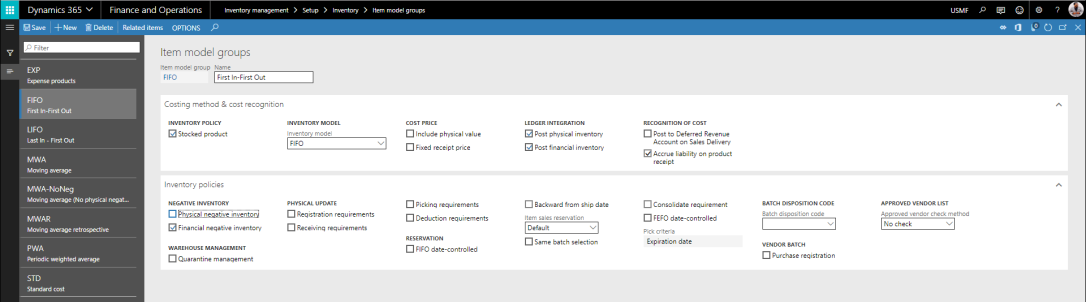

Item Model Group:

The item model group field is used to determine how items are controlled and handled on receipt, issue, and also calculating consumption.

An item model group can be assigned to multiple items which can assist in the control of several items using the same setup. In the next demonstration, we will further explain the fields that can be selected when setting up an item model group.

Navigation : Inventory Management –> Inventory –> Item Model Group.

Stocked Product:

Select this option to indicate that the product should be handled in inventory. Products that are handled in inventory generate inventory transactions. These products can be included in cost calculations.

On-hand quantities can also be maintained for these products. Stocked products include items and services. A service cannot be added to stock. However, the program requires that pro forma stock transactions be generated for services that contribute to the inventory value of tangible goods. For example, pro forma stock transactions must be generated if a service is used to subcontract production steps.

Inventory model:

This value will be used to close and perform adjustments in the close and adjustment process.

Example: FIFO, LIFO, LIFO Date, Weighted Avg, Weighted Avg Date, Standard Cost and Moving Average.

Include physical value:

This indicates that the transactions that are physically updated should be included in calculating the average cost.

Select this option to indicate that transactions that are physically updated should be included in the calculation of the average cost. At inventory close, this parameter may be used, depending on the method that is used for inventory valuation. The following inventory valuation methods use this

parameter during inventory close: FIFO, LIFO, and LIFO date. The following inventory valuation methods do not use this parameter during inventory close: Weighted avg. and Weighted avg. date.

Fixed receipt price:

Used to adjust issues and receipts to a fixed receipt price.

Select this option to adjust issues and receipts to a fixed receipt price. The fixed receipt price is a principle for inventory valuation that sets the price of receipts to the active planned cost or basic cost of a product. The fixed receipt price is defined in the Price field on the Manage costs tab in the Released product details page. When this option is selected, receipts and issues are posted as follows: for purchase receipts, posting occurs at the actual cost; for purchase invoices, the price difference between the actual cost and the fixed receipt price is posted to the general ledger as a variance; the amount is posted to the loss or profit account for the fixed receipt price. Inventory is updated based on the fixed receipt price; and for sales order packing slips and sales invoices, posting occurs at the estimated cost. When you run an inventory close or a recalculation, if this option is selected, the value of issue transactions is adjusted according to the price that is specified in the Price field. If this option is cleared, the value of issue transactions is not adjusted according to this price. If the fixed receipt price is changed, and you want all new issue transactions to use the new cost, follow these steps: run an inventory close, adjust the balance for the on-hand inventory, so that the balance matches the new cost, and then activate a new planned cost.

Post physical inventory:

If checked, this will post the physical item transactions in the ledger.

Select this option to post physical item transactions in the ledger. The physical item transactions are posted as follows: packing slips and product receipts are posted if the Post product receipt in ledger option is selected in the Accounts payable parameters page, or if the Post packing slip in ledger option is selected in the Accounts receivable parameters form; and production orders that are reported as finished are posted if the Post report as finished in ledger option is selected in the Production control parameters page. If this option is cleared, packing slips, product receipts, and production orders that are reported as finished are not posted in the ledger, regardless of the settings in the parameter setup pages.

Post financial inventory:

If checked, this will post the updated financial value of the items in the ledger.

Select this option to post the updated financial value of items in the ledger. When a purchase order is invoice-updated, the value of the items is posted to the inventory receipt account. When a sales order is invoice-updated, the value of the items is posted to the inventory issue and the consumption accounts. The inventory value that is posted can then be reconciled with the related status accounts in General ledger. If this option is cleared, when a purchase order is invoice-updated, the value of the items is posted to the item consumption account, but not to the inventory receipt account. When a sales order is invoice-updated, no posting occurs in the item consumption account or the issue account. Clear this option for service items if the item consumption should not be posted when sales orders are invoiced. When this option is cleared, the journal lines for the items do not generate ledger postings.

Post to deferred revenue account on sales delivery:

This field is used to accrue the estimated revenue for the delivered quantity of a packing slip. The accrued revenue that’s accounted for on the delivery is offset when the customer is invoiced.

Accrue liability on product receipt:

This will accrue the estimated expense for the product receipt update to the ledger.

Physical negative inventory:

If this is checked, then when the item model group is assigned to an item, inventory quantities are allowed to go negative. This flag can be used in conjunction with the storage dimension groups active dimensions.

Select this option to enable negative physical inventory for the item model group. The program does not verify that items are physically in inventory when items are picked. For example, production is started, but not all items for the production are in inventory. The items have been ordered, and delivery has been scheduled. Alternatively, an order for an item is updated. Even though the item is not in inventory, it has been purchased and will soon be in inventory.

Financial negative inventory:

This enables negative financial inventory for the items assigned to the item model group. Negative financial inventory is often used for services. If the checkbox is cleared, the cost price must be known for the quantity that’s financially removed from inventory.

Select this option to enable negative financial inventory for the item model group. Negative financial inventory is often used for services. If this option is cleared, the cost price must be known for the quantity that is financially pulled from inventory. For example, eight items are invoice-updated, and five other items are packing slip–updated. Therefore, the physical on-hand inventory is 13. If this option is cleared, negative financial inventory is not enabled. Therefore, only eight items are available when a sales order is invoice-updated, even though 13 items are available in on-hand inventory.

Quarantine management:

If marked, this indicates that items associated with this item model group will be processed based on quarantine management rules and requirements. In the physical update field group, the first parameter is registration requirements.

Select this option to indicate that items that are associated with the item model group are subject to the rules and requirements for quarantine management. This option is used for items that are set aside and awaiting approval for distribution. If this option is cleared, items are not under quarantine management, unless a quarantine order is created manually in the Quarantine orders page. When the item is registered, a quarantine order is generated. This quarantine order has a status of Started.

Registration requirements:

This parameter would be selected to indicate that item receipts must be registered prior to inventory being physically updated.

Select this option to indicate that item receipts must be registered before inventory is physically updated. The status of the inventory transaction for the item receipt must be Registered before the item’s product receipt is updated. This field is used by warehouse management. Registered items are part of physical inventory. You can register items in the warehouse management journals. Alternatively, you can click Inventory, and then click Registration on the relevant journals and orders.

Receiving requirements:

This parameter would be selected to indicate that item receipts have to be physically updated before they can be financially updated.

Select this option to indicate that item receipts must be physically updated before they can be financially updated. If you post a vendor invoice, a product receipt must be entered and posted before the vendor invoice for the product receipt can be posted. The received quantity on the product receipt might differ from the invoiced quantity. In this case, an icon is displayed in the Product receipt quantity match field in the Vendor invoice page.

Picking requirements:

If this parameter is checked, items must be picked before inventory is updated physically.

Select this option to indicate that item issues must be picked before inventory is physically updated. The status of the inventory transactions for the item issue must be Picked before the packing slip is updated. This field is used by warehouse management. Picked items are part of physical inventory. Items can be picked in the warehouse management system by dispatches and picking routes. Alternatively, you can click Inventory, and then click Registration on the relevant journals and orders. If you create a direct delivery from a sales order, the Picking requirements parameter is ignored, because items are transferred directly from the vendor to the customer. These items do not physically come into your company

Deduction requirements and FIFO Date Controlled:

Selecting this checkbox indicates that the item deductions have to be physically updated before they can be financially updated. Under the reservation section, we have FIFO date controlled and backward from ship date options.

Select this option to indicate that item deductions must be physically updated before they can be financially updated. If you post a vendor invoice, a product receipt must be entered and posted before the vendor invoice for the product receipt can be posted. The deducted quantity on the product receipt might differ from the negative invoiced quantity. In this case, an icon is displayed in the Product receipt quantity match field in the Vendor invoice page.

Backorder from ship date field, Item Sales Reservation and Pick Criteria:

This would be checked if you want to reserve expected receipts such as open purchase order lines that have a date of receipt that’s nearest to the delivery date of the sales order. If the checkbox is cleared, incoming inventory transactions having the earliest date of receipt will be reserved. The FIFO date controlled and pick criteria drop-down work together and that if the FIFO date control flag is checked, the pick criteria field is then enabled. The pick criteria field allows you to choose if the product should be picked based on the expiration date or if the date should be used as the best before date.

FEFO date-controlled:

Performs “first-expired-first-out” date-controlled reservation, which is used only for shelf life items. Select this if the oldest inventory batch that fulfils the complete order quantity should be reserved. When you set this flag you can select the Pick criteria when you perform picking, manual or automatic reservation, or master planning.

Vendor check method:

This can be used to enforce if a product can only be purchased from a vendor active on the item. In the drop-down, you can select no check; warning only, which will allow you to still create the purchase order but will give you a warning upon adding the item to the purchase order; and the last option is not allowed, which will be a hard stop if the item vendor combination is not active.

Inventory costing

Inventory costing plays a significant role in knowing the true financials of an organization and is quite a comprehensive topic. This post is share knowledge about various costing options, however their

Fitment to the business model, industry vertical, compliance, etc. requires a detailed exercise, niche expertise and spans multiple domains cost accounting, financials, supply chain, etc.

Sharing insights on inventory costing models available in New Microsoft Dynamics AX and their behind the scenes calculations:

- FIFO

- LIFO

- LIFO dated

- Weighted average

- Weighted average dated

- Moving average

- Standard cost.

Let’s assume that a shopkeeper purchases 6 items for the cost of Rs 50 and 4 items for the cost of

Rs 55. So, the total items’ cost is 6*50 + 4*55. The company sells 4 items.

Now, there are 6 + 4- 4 = 6 items in the company warehouse.

So the possible cost of item remained in the warehouse are:

Possible Combinations:

- (6 – 4) * 50 + 4 *55 = Rs 320 (The company has sold 4 items that cost Rs 50)

- (6 – 2) * 50 + (4 – 2) *55 = Rs 310 (The company has sold 2 item that costs Rs 50 and 2 item that costs Rs 55)

There will other variants like 1 from Rs 50 and 3 from Rs 55, 3 from Rs 50 and 1 from Rs 55, etc.

We cannot come to the point exactly about the item’s cost that is remaining in the warehouse because we only know that there are 6 items remaining in the warehouse and we don’t know which items are sold.

We can set up the following rules for an inventory models to calculate item’s cost:

FIFO – First in First out.

Means that the first purchased item is first sold.

So in our case, shopkeeper has 6 items for the cost of Rs 50 first, so these items will be first sold. After the items are sold, the items’ cost in the warehouse will be (6 – 4) * 50 + 4 * 55 = Rs 320

LIFO – Last in First out.

Meaning that the first purchased item is last sold.

So in our case, shopkeeper has purchased 4 items for the cost of Rs 55 last, so these items will be first sold.

After the items are sold, the items’ cost in the warehouse will be 6 * 50 + (4 – 4) * 55 = Rs 300

Weighted avg.

In this case, the average cost is calculated and subtracted from the warehouse items’ cost when the item is sold.

So in our case, shopkeeper has average cost is (6* 55 + 4 * 50) / 10 =Rs 53.

After the items are sold, the items’ cost in the warehouse will be (10 – 4) * 53 = Rs 318

Standard cost

This inventory model uses a specific price as cost. The price can be entered manually or calculated automatically. This price is used as cost for purchase and selling.

For example, if the shopkeeper has set the standard cost price of Rs 49. So, we purchase all items for this price Rs 49.

The total items’ cost before the selling is 6 * 49 + 4* 49 = 490. After 4 items are sold, the items’ cost in the warehouse will be (10 – 4) * 49 = 294.

LIFO date

This model equals to LIFO with the only difference being that purchase and selling dates are taken into account.

For example, a company purchases four items for the cost of Rs 50 on 11th Jan, three items for the cost of Rs 55 on 11th Jan and two items for the cost of Rs 47 on 13th Jan.

The company sells two items on 11th Jan, but the Sales manager was out of office and didn’t post the sales. The Sales manager came back to the office on 13th Janand posted the sales backdate to 11th Jan.

The sales posting process will decrease the cost of items in the warehouse at 2 * 55 (item’s last cost as of 11th Jan).

If the LIFO inventory model is used, the sales process will decrease the cost of items in the warehouse to 2*47 (because 7$ is the last cost received into the warehouse).

Weighted avg. date.

This model equals to the Weighted avg with the only difference being that the average amount is calculated for a separate day.

For example, a company purchases four items for the cost of Rs 50 on 11th Jan, three items for the cost of Rs 55 on 13th Jan and two items for the cost of Rs 47 on 13th Jan.

The company sells two items on 13th Jan. The average cost price will be (3* 55 + 2 * 47) / (3 +2) = Rs 259.

Note: 4 items at the price of Rs 50 are not included in the average cost price calculation because they have been purchased on another day.